Benchmarking basics. What is it and how do you do it?

Benchmarking is a very powerful tool many organizations use to not only measure and gauge their performance against the competition but also to push themselves to be best-in-class. Benchmarking is a source of competitive advantage and continuous improvement (Kaizen). Thus, understanding benchmarking basics can be crucial in a certain business situation.

Wikipedia defines benchmarking as:

Benchmarking is the process of comparing one’s business processes and performance metrics to industry bests and best practices from other companies. Dimensions typically measured are quality, time and cost. In the process of best practice benchmarking, management identifies the best firms in their industry, or in another industry where similar processes exist, and compares the results and processes of those studied (the “targets”) to one’s own results and processes. In this way, they learn how well the targets perform and, more importantly, the business processes that explain why these firms are successful.

Also referred to as “best practice benchmarking” or “process benchmarking”, this process is used in management and particularly strategic management, in which organizations evaluate various aspects of their processes in relation to best practice companies’ processes, usually within a peer group defined for the purposes of comparison. This then allows organizations to develop plans on how to make improvements or adapt specific best practices, usually with the aim of increasing some aspect of performance. Benchmarking may be a one-off event, but is often treated as a continuous process in which organizations continually seek to improve their practices.

Critical to the benchmarking process is access to relevant, accurate benchmarking data. So, where do you get this data? This depends on the type of benchmarking you would like to do. There are five types of benchmarking.

Benchmarking categories

- Internal Benchmarking: This compares one particular operation within our organization with another. Internal benchmarking is by far the easiest – both to research and to implement. Productivity improvement achieved in this type is usually about 10%.

- Competitive Benchmarking: This compares our operation with that of our direct competitors. This is the most difficult type of benchmarking to carry out successfully, and legal considerations must always be kept in mind. Productivity improvement achieved is usually about 20%.

- Functional Benchmarking: The process of comparing operation with that of similar ones within the broad range of our industry (e.g. copper mining techniques compared with coal mining techniques). Productivity improvement achieved maybe 35% or better.

- Generic Benchmarking: This compares operations from unrelated industries. The advantage of this is that the problems of competition do not apply, thereby increasing the access to information and reducing the possibility of legal problems. Productivity improvement achieved maybe 35%+.

- Collaborative Benchmarking: This is carried out collaboratively by groups of companies (e.g. subsidiaries of a multinational in different countries or an industry organization). Groups of companies agree to share internal benchmarking data. Large consulting firms are often hired due to their access to competitive benchmarking information, which they have acquired by working with large numbers of companies.

Approach to benchmarking

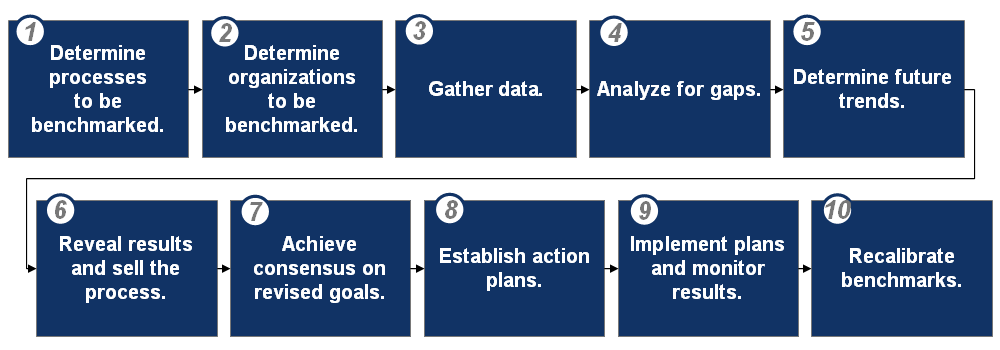

So, how do you perform benchmarking? First, it is important to note, unlike some other frameworks, for benchmarking, there is no single process that has been universally adopted. Here is a 10-step approach to benchmarking.

Step 1. Determine processes to be benchmarked

This initial step involves defining as accurately as possible the process to be benchmarked. It is the cornerstone of the entire benchmarking process. An incorrect identification at this stage could result in a waste of precious resources at later steps. In the end, we will have a sharply focused, clearly defined procedure that tells management what needs to be changed, how much change can be achieved within given limitations, and how to measure accurately our processes against those of others and our future projections.

Step 2. Determine organizations to be benchmarked

This step determines which organizations should be studied by identifying the best organizations whose practices can be adapted to our requirements. An incorrect choice could lead to electing partners that are not true benchmarks for the selected process, that are uncooperative, or whose practices are incompatible or irrelevant to our needs. After step 2, we will have compiled a large list from which to choose organizations to contact as potential partners, based on the superior quality of their processes.

Step 3. Gather data

The third step involves creating a plan for collecting data from selected targets, conducting site visits, and creating a site visit report. Upon finishing step 3, our organization will have complete, accurate and relevant data with which to compare its processes with “the best of the best.”

Step 4. Analyze for gaps

This step involves analyzing the data collected, discovering to what degree present performance lags behind the best in each area, and combining the best features from the best practices into an ideal process. At the completion, relevant features from each of the best practices will combine into an ideal practice that can be implemented within budgetary and other constraints of our organization.

Step 5. Determine future trends

In this step, we will examine our organization’s past performance concerning competitors, forecast potential change in our industry, and project future performance, both with and without the proposed benchmarking changes. After this step, we will have identified the quantitative benefits of implementing the proposed benchmarking changes.

Step 6. Reveal results and sell the process

This step involves communicating the benchmarking results and their implications to significant audiences in the organization and motivating them to carry out changes. This step will ensure that the advantages of change have been explained to the parties and stakeholders involved to motivate them to carry it out.

Step 7. Achieve consensus and revised goals

This step involves revising goals to close the performance gap determined in step 5 and achieving consensus on those goals. Step 7 establishes clear-cut goals that our management has approved and that all employees understand.

Step 8. Establish action plans

This step establishes the step-by-step plan designed to bring about the goals created and approved in step 7. Upon completion of step 8, management has approved the specifics of the plan, appropriate individuals have been empowered to carry it out, and every individual knows what changes in his or her work procedure are expected.

Step 9. Implement plans and monitor results

In this step, we execute the approved best-practice procedures and the day-to-day monitoring of changes. Step 9 develops procedures to enable close monitoring of the changes and tracking of results so that, over time, successful elements of the new practices can be retained and the less successful ones eliminated.

Step 10. Recalibrate benchmarks

We must continuously evaluate the benchmarked practices and reinstitute the benchmarking process when necessary. After step 10 (and the conclusion of this benchmarking approach), the organization will understand when and how it needs to recalibrate benchmarks and will never put itself at risk by becoming complacent.

Comments

No comments currently.