25 Year Balanced Scorecard History: The 1st Generation – part one

by James Creelman and Elena Gómez Domenech. Reviewed and approved by Drs. Kaplan and Norton

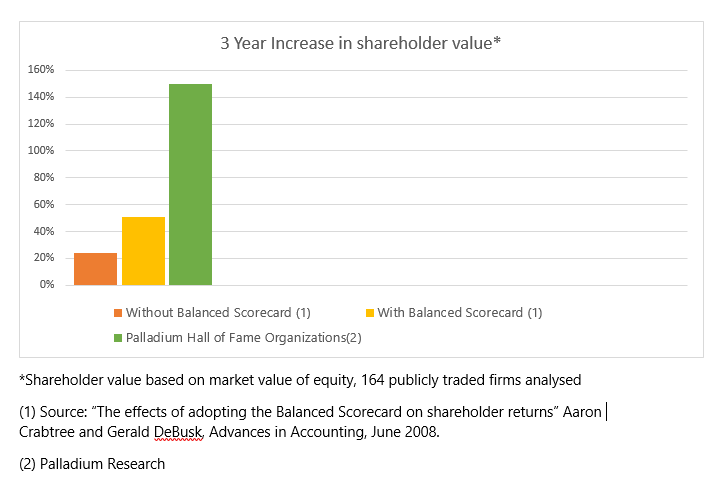

Fully 25 years post its introduction through a Harvard Business Review article in 1992, the Balanced Scorecard (BSC) is still one of the most popular management tools among organizations throughout the world. As of 2015, it ranked #6 for both usage and satisfaction in Bain & Company’s annual Management Tools & Trends survey (1). Moreover, independent research demonstrates that organizations using the framework achieve superior shareholder value than non-users. Those that have been inducted into the Palladium Hall of Fame for Strategy Execution™ report even greater shareholder returns. (Figure 1). Not-for-profit organizations report comparable benefits.

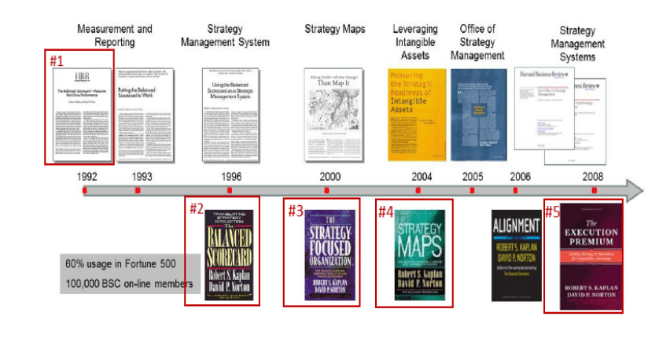

In this series of four articles, we assess how the Balanced Scorecard concept has evolved since the initial article through to the Execution Premium book in 2008, and discuss more recent developments. We explain how the concept and methodology developed from a “balanced” measurement tool to a comprehensive strategic management system, and one that is perfectly adaptable to the organizational challenges of the digital age.

Although we progress through the works sequentially, it is important to note that the publication of the works does not represent steps from a basic to an advanced application of the Balanced Scorecard. For instance, the most important component of the Balanced Scorecard system is the Strategy Map, which was not explained until book 2 (Strategy-Focused Organization) and was fully described in book 3 (Strategy Maps).

Therefore, to better frame an understanding of how the books best describe the Balanced Scorecard system, we will use Kaplan and Norton’s three-component “formula” that explains how organizations achieve breakthrough results:

- Describe the strategy

- Measure the strategy

- Manage the strategy

You can’t manage (component 3) what you can’t measure (component 2) – and you can’t measure (component 2) what you can’t describe (component 1)

Kaplan and Norton’s first book, The Balanced Scorecard (1996), focuses on the second component – how to measure strategic objectives in four perspectives (Financial, Customers, Internal Business Processes, Learning and Growth). It also introduces the first notions about how to manage the strategy. The Strategy Maps book (2004) – which develops a concept introduced earlier in The Strategy Focused Organizations book (2001) – addresses the first component of the formula and explains how to describe the strategy using Strategy Maps.

The second and fifth books, The Strategy Focused Organization (2001) and The Execution Premium (2008) develop in further detail the management of the strategy – the third component. The Execution Premium is the culmination of all the work developed by Kaplan and Norton in the field and represents the state of the art strategy execution framework. We do not specifically discuss the fourth book on Alignment (2006) as the major learnings are highlighted within the other books.

To understand the key to successfully delivering breakthrough performance in your organization, be sure to download a free copy of the eBook, ‘The key to Strategy Execution’ today – the perfect accompaniment to our BSC deepdive. Click here to download your copy.

1.The Balanced Scorecard – Measures That Drive Performance (1992)

Kaplan and Norton published the first article on the Balanced Scorecard in the Harvard Business Review in 1992. They explained the results of their 1990 research involving 12 companies (such as Apple, HP and Analog Devices) that led to the initial Balanced Scorecard framework.

Leveraging on the much-used mantra, “what you measure is what you get”, the result of the research was a compelling alternative to the traditional performance measurement systems that were based on financial accounting measures. The argument was that traditional financial-based measures stimulate short-term thinking and fail to promote new kinds of behaviours based on the intangible assets which are key to succeed in the post-industrial (or knowledge) era, such as innovation, data-based decisions, customer relationships or employees’ skill-sets and motivation, among others.

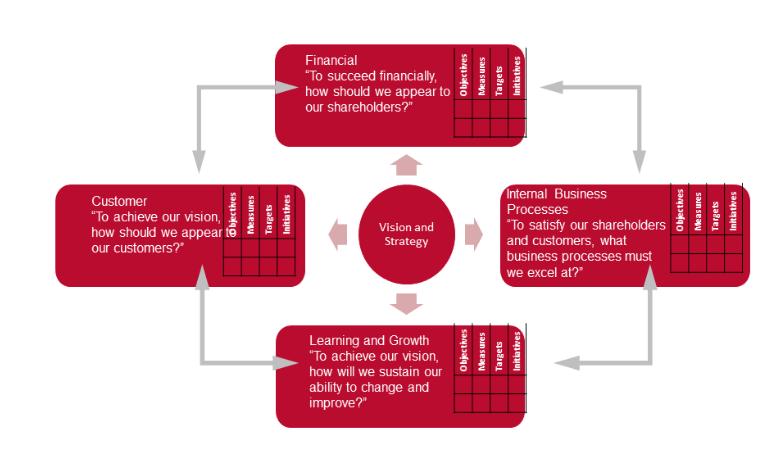

Acknowledging the continued importance of financial measures, Kaplan and Norton developed a framework that combines financial and non-financial measures. The Balanced Scorecard includes measures to respond to four key questions, which together provide a holistic overview of business performance:

- Financial perspective: How do we look to shareholders?

- Customer perspective: How do customers see us

- Internal perspective: What processes must we excel at?

- Innovation and learning perspective: Can we continue to improve and create value? (By the time of the first book in 1996 this perspective had been renamed learning & growth as the authors had come to understand that innovation more appropriately belonged in the internal perspective). (Figure 3).

The publication of the Balanced Scorecard article generated considerable interest among executives. Kaplan & Norton worked with several companies to implement major transformation programs using the Balanced Scorecard (such as Cigna Property & Casualty, Brown & Root, Chemical Bank and Mobil Oil North American operations). With the consulting primarily led by Dr. Norton, it was observed that in best practice implementations, the Balanced Scorecard was not just used as a measurement tool, but a core management system – it was used not just to measure, but also to clarify, communicate and manage the strategy.

2. The Balanced Scorecard: Translating Strategy into Action (1996)

Kaplan & Norton’s first book, written four years after the first article, is structured in two parts.

- Part 1: How to build a Balanced Scorecard

- Part 2: How to use the Balanced Scorecard as an integrated strategic management system

Part 1: How to build a Balanced Scorecard

Here, Kaplan and Norton describe how to develop and plan the Balanced Scorecard, perspective by perspective.

They start with the Financial perspective. The logic to start the Balanced Scorecard with the Financial perspective and end with the Learning and Growth perspective is that, “the scorecard should tell the story of the strategy, starting with the long-run financial objectives, linking these to the sequence of actions that must be taken with financial processes, customers, internal processes, and finally employees and systems (Learning and Growth) to deliver the desired long-term economic performance.”

Secondly, they develop the Customer perspective. For defining the right measures in this perspective, Kaplan and Norton state that managers need to identify their targeted customers and select the key outcomes (market share, acquisition, retention, satisfaction and profitability). To assess progress to the outcomes, they suggest lagging measures that report the results of marketing, logistics or customer service processes.

But these measures do not anticipate bad customer outcomes. Therefore, it is important to understand the value to targeted customers’ value and measure the delivery of that value proposition. Value proposition attributes are classified in three groups: product and price (functionality, quality and price), customer relationship (quality of purchasing experience and personal relationships) and image and reputation. These value propositions are leading indicators of the customers’ outcomes and help the companies act before any negative impact on customer/financial outcomes.

In the Internal perspective, companies measure those processes that will deliver the objectives defined for customers and shareholders. This is one of the key differences with other measurement systems, which only focused on financial measures to control the performance of departmental operations. Enhanced systems include non-financial metrics to measure the performance of the business processes, such as quality, time and throughput measures. However, there is no competitive and sustainable differentiation in trying to improve these dimensions of the business processes performance- all companies try the same. The strength of the Balanced Scorecard approach is that business process objectives and measures are derived from the company strategy to deliver targeted customer value propositions. Accordingly, “this sequential, top-down process will usually reveal new business processes at which an organization must excel”.

Finally, the Learning and Growth perspective contains the key infrastructure objectives and measures required to successfully deliver the financial/customer/internal objective. Here the word “infrastructure” refers to the capabilities of people and systems and the organizational climate. By having a specific perspective for these kinds of intangible assets, the Balanced Scorecard stresses the importance of investing for the future and not just in traditional elements such as Research & Development (R&D) or machinery.

Kaplan and Norton argue that a successful Balanced Scorecard is one that can measure the implementation of the organization’s strategy and provide three reasons why this is important:

- The scorecard is a powerful way to describe and create a shared understanding about the organization’s vision of the future.

- By representing the strategy of the organization, the scorecard allows all employees to see their contribution to organizational success. If this linkage is lacking, employees and departments can optimize their individual and group performance, but will not necessarily be contributing to the achievement of the strategic objectives.

- The scorecard enables the organization to focus on the right (strategic) aspects. When the right objectives and measures are identified, the chances of a successful strategy implementation increase.

Three principles enable the effective translation of the strategy into a Balanced Scorecard set of measures:

- Cause and effect relationships. A Balanced Scorecard should express the story of cause and effect hypothesis on which the organization’s strategy is made. Each measure in the Balanced Scorecard should be connected according to the existing hypothesis, so that the cause and effect relationships can be monitored and managed.

- Performance drivers. Balanced Scorecards must properly balance lagging and leading indicators. Lagging indicators are normally outcomes measures and tend to be generic (for example, revenues, profits, customer satisfaction). The performance drivers of those outcomes reflect the distinctiveness of the organization’s strategy and tend to be leading indicators (for instance, the drivers of profitability or the specific value proposition for a targeted customer segment). Leading measures or performance drivers communicate how the outcomes will be achieved.

- Linkage to financials. In many organizations, internal business processes programs have incorrectly become an ultimate goal, when all the measures in the Balanced Scorecard should eventually be linked to the achievement of the ultimate outcomes, which in private sector organizations will be financial performance, and within most Government and not-for-profits will be results for stakeholders.

In the last chapter of the first part of the book, Kaplan and Norton take a look beyond the “autonomous business unit” concept to which they usually relate the Balanced Scorecard. They explain how other forms of organizational structures can benefit as well from using the Balanced Scorecard, including corporations that combine several business units, joint ventures and support departments. Interestingly, their earlier articles were focused on private sector companies, but in their first book, they do highlight the large opportunity for the Balanced Scorecard to improve the management of public sector organizations and explain how to interpret and adapt the four perspectives accordingly.

More organizations than ever are failing to close the gap between strategy and operational activity. What is the cost in real terms? Click here to view an ROI of Strategy Execution infographic.

Part 2: How to use the Balanced Scorecard as an integrated strategic management system

Here, Kaplan and Norton describe how to use the Balanced Scorecard as an integrated strategic management system. They explain that those organizations that have achieved breakthrough results when using the Balanced Scorecard are those which have it embedded into their strategy management mechanisms.

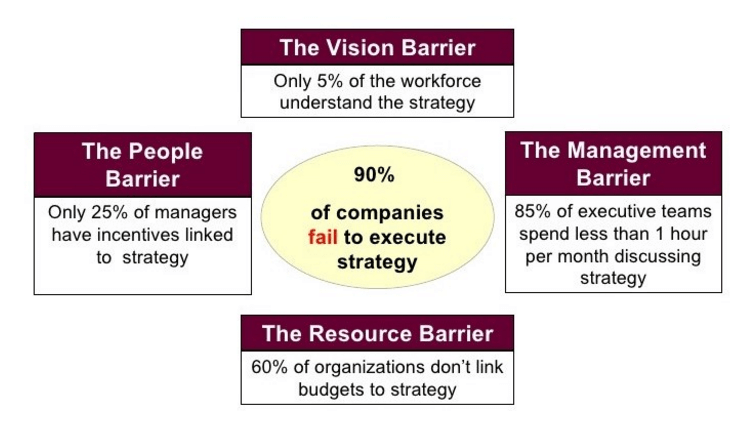

Kaplan and Norton identified a disconnect between the development and formulation of strategy and its implementation: a key problem which prevents many organizations from achieving their targeted results: They provided four main reasons for this gap:

- Visions and strategies are usually not expressed in actionable terms

- Strategic priorities fail to be linked to departmental, team, and individual goals

- Resource allocation too often is not linked to strategic priorities

- Feedback mechanisms normally do not provide answers to the question “is the strategy working?” Instead, feedback tends to focus on short-term, tactical and financial measures which do not provide robust indicators of the success of the strategy implementation.

To overcome these barriers and bridge the gaps to successful strategy execution, Kaplan and Norton recommend to use the Balanced Scorecard as the cornerstone of a new strategic management system structured around four principles. Figure 4.

- Clarify and translate the vision and strategy – The process of developing the Balanced Scorecard clarifies the strategic objectives, identifies the critical few drivers for strategic success, and creates consensus among the top leaders around the strategic priorities of the organization.

- Communicate the strategy and align all the organization to it – The execution of the strategy depends on all the employees working towards the achievement of the strategic priorities. But they cannot execute what they are not aware of or do not understand. The first notions about strategy alignment are introduced in this book and will be developed in the next book that explains the Strategy Focused Organization and in a latter book solely dedicated to the topic – Alignment.

- Planning and Target Setting – As well as human resources alignment, for strategy to be successfully implemented, financial and physical resources also need to be properly aligned. Kaplan and Norton present four steps to integrate strategy planning, resource allocation and budgeting processes around the Balanced Scorecard.

-

-

- Establish stretch targets. Define ambitious targets for measures that all employees can accept and buy into. The cause-and-effect relationships in the Balanced Scorecard will identify the critical drivers to achieve the outcome measures.

- Identify strategic initiatives. Identify the key initiatives that are needed to close the gaps between the targets defined for scorecard measures and current performance on those measures.

- Identify critical cross-business initiatives. Managers identify those initiatives that have a positive impact on the strategic objectives of a different business unit.

- Link to annual resource allocation and budgets. Link the 3-5-years strategic plan to the budget for the next year. This enables the tracking of the business unit’s trajectory along its strategic journey.

-

- Strategic feedback and learning – The authors argue that strategies in the post-industrial era, in general, are not as linear and stable as previously. When operating in complex and rapidly changing environments, managers often need to question their planned strategies and take new opportunities or react to unexpected threats: organizations, they argue, need to continuously learn.

To gauge your ability to successfully use a BSC to deliver your strategic initiatives, try StratexAssess, the free strategy deployment survey, designed to help you target areas of weakness in your strategy engine. Click here to start your assessment.

Parting words

In part two of this series, we outline the key ideas, concepts and principles of the Strategy-Focused Organization. This was Kaplan and Norton’s second book and was based on their observations of the interventions of the early adopters that have gained the greatest benefits from adopting this ground-breaking new approach to managing strategy.

Reference

- Bain & Company’s annual Management Tools & Trends, 2015.

Elena Gómez Domenech is Director, the Palladium Group, with primary responsibility for knowledge management as well as consulting assignments.

Before joining Palladium in 2005, Elena worked for INDRA GROUP as a project leader in consulting assignments, with a focus on the development of strategic, e-business and organizational plans for leading Spanish organizations. Elena holds Master and Bachelor degrees in Business Administration from ESADE (Barcelona, Spain).

Comments

No comments currently.